Impact of Tripling of Capital Gains Tax on Property Sales in Kenya Effective January 1, 2023

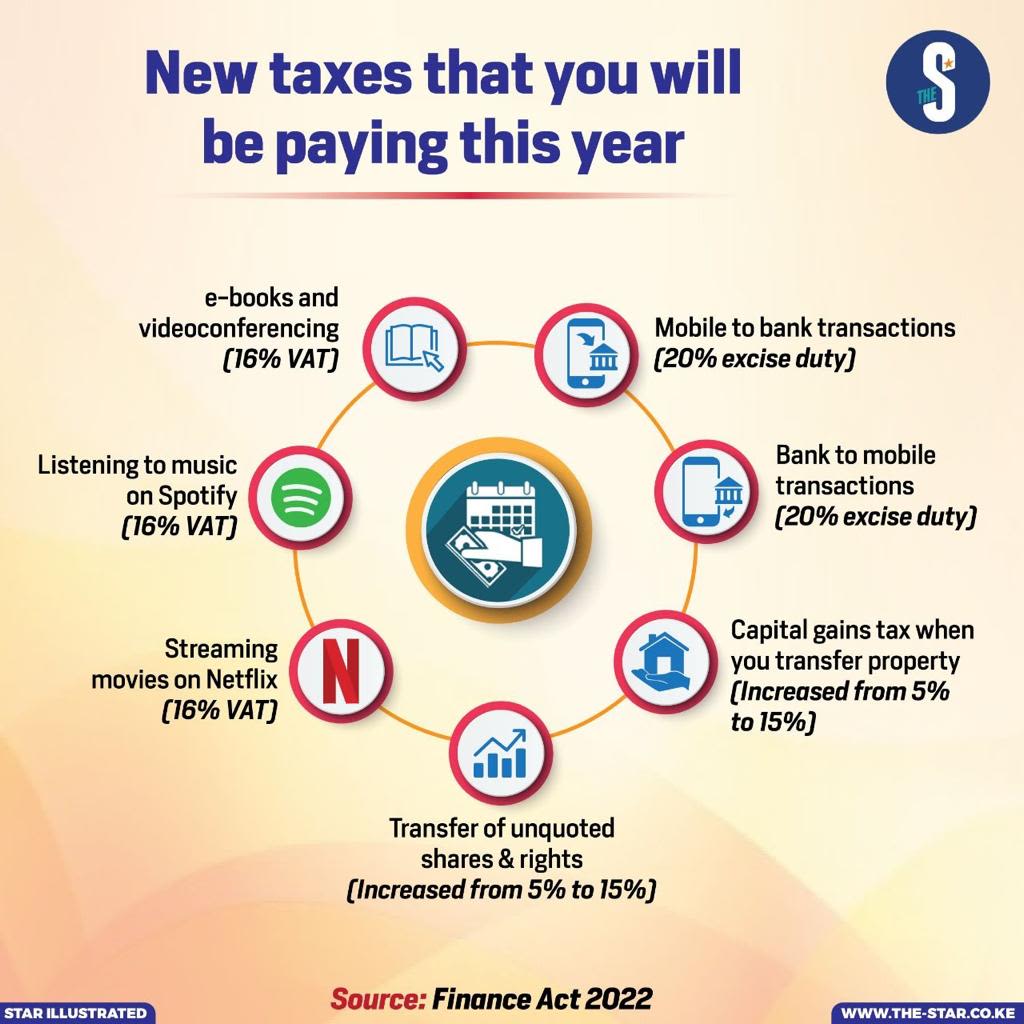

The Finance Act of 2022 amended the Income Tax Act, increasing the rate of capital gains tax, or CGT, from 5 percent to 15 percent (effective from January 1, 2023)

Capital Gains Tax (CGT)

CGT is a tax imposed on the transfer of property situated in Kenya that was acquired on or after January 2015. It is declared and paid by the transferor of the property.

A transfer of property includes the exchange, conveyance, or other disposition of property, as well as the destruction, abandonment, surrender, cancellation, or forfeiture of property. Examples of properties that may incur CGT when transferred include land, buildings, securities, and shares.

The rate of Capital Gains Tax in Kenya is determined by the specific circumstances of the transfer. For example, a firm certified by the Nairobi International Financial Centre Authority that invests KES 5 billion in Kenya and transfers the investment after five years will be subject to a rate that was in effect at the time of the investment. This means that if the firm invested before the CGT rate was increased to 15 percent, it would still be subject to the lower rate of 5 percent when it makes the transfer.

Allowable expenses to compute CGT in Kenya include costs incurred concerning the transfer of A property, such as a loan/mortgage interest, advertising costs, valuation costs, legal fees, and enhancement costs.

To compute CGT, the net capital gain is calculated by subtracting the allowable expenses and any exemptions from the total capital gain. For example, if the total capital gain on the transfer of a property is KES 10 million and the allowable expenses are KES 2 million, the net capital gain would be KES 8 million (KES 10 million KES 2 million).

The CGT due would then be calculated by applying the applicable rate (in this case, 15 percent) to the net capital gain, resulting in a CGT liability of KES 1.2 million (KES 8 million x 15%).

To pay CGT in Kenya, the individual or entity responsible for the transfer must file a return with the Kenya Revenue Authority (KRA) within three months of the transfer. The tax must then be paid within 30 days of filing the return.

There are certain exemptions to CGT in Kenya, such as the transfer of property to secure a loan, the transfer of assets between spouses, the transfer of shares listed on the Nairobi Securities Exchange, and the transfer of property by a creditor to return property used as security for a debt or loan.

We believe that the triple increase in capital gains tax may result in:

- Decreased sales for property, leading to a slowdown in the real estate market.

- Decreased supply of property; some may choose to hold onto their property rather than sell and pay higher taxes.

- Decreased investment in property as higher taxes may discourage new investors due to the higher capital gains tax on real estate.

- Negative impact on economic growth in Kenya, including potential consequences for the construction and real estate industries and related industries such as lending and insurance.

- Decreased commission for property agents as some sellers may reduce commissions in response to the higher tax burden.

- Decelerate the affordable housing plan as a result of higher capital gains tax on sale of land in kenya.

Check out Everything you Need To Know about Capital Gains Tax by KRA.

We hope this information helps understand the capital gains tax laws and computation in Kenya. Please note that the contents of this newsletter are intended to provide a general guide to the subject matter. It should not be relied upon without legal and financial advice on its contents.

Should you require further information or legal assistance on Compliance or any other legal, kindly feel free to contact William Karoki or WKA ADVOCATES Nairobi Hub: Parklands, Valley View Business Pork, 6''' Floor, City Park Drive, Off Limuru Road.